(Nasdaq: EXPE).Īs of May 2017, 64% of the analysts covering HDP recommend it as a buy. On top of all this, the data management expert even offers the Hortonworks Data Cloud for Amazon Web Services, which analyzes and processes data.Īnd because of its expertise, Hortonworks has an impressive client list that includes Bloomberg, eBay Inc. Its Hortonworks Data Platform allows its customers to collect, store, process, and analyze existing data.

SPOTIFY IPO PRICE SOFTWARE

Hortonworks creates, distributes, and supports enterprise data management software solutions. VIDEOHow Hortonworks Operatesīut that's okay – it means Money Morning readers will be the ones who could profit the most. With a market cap just over $600 million, most investors haven't heard of this tech company. In California, there's a little-known company called Hortonworks Inc. (Nasdaq: HDP) that is one of Spotify's major suppliers for data management.

SPOTIFY IPO PRICE HOW TO

This isn't on Wall Street's radar, which is why I had to make sure you knew about it today… How to Net Market-Beating Gains Before the Spotify IPO Over the next 12 months, this investment could climb another 88%. This investment opportunity has netted gains of 35.68% since I first brought it to the attention of Money Morning readers on March 28.If you missed it, that's okay.

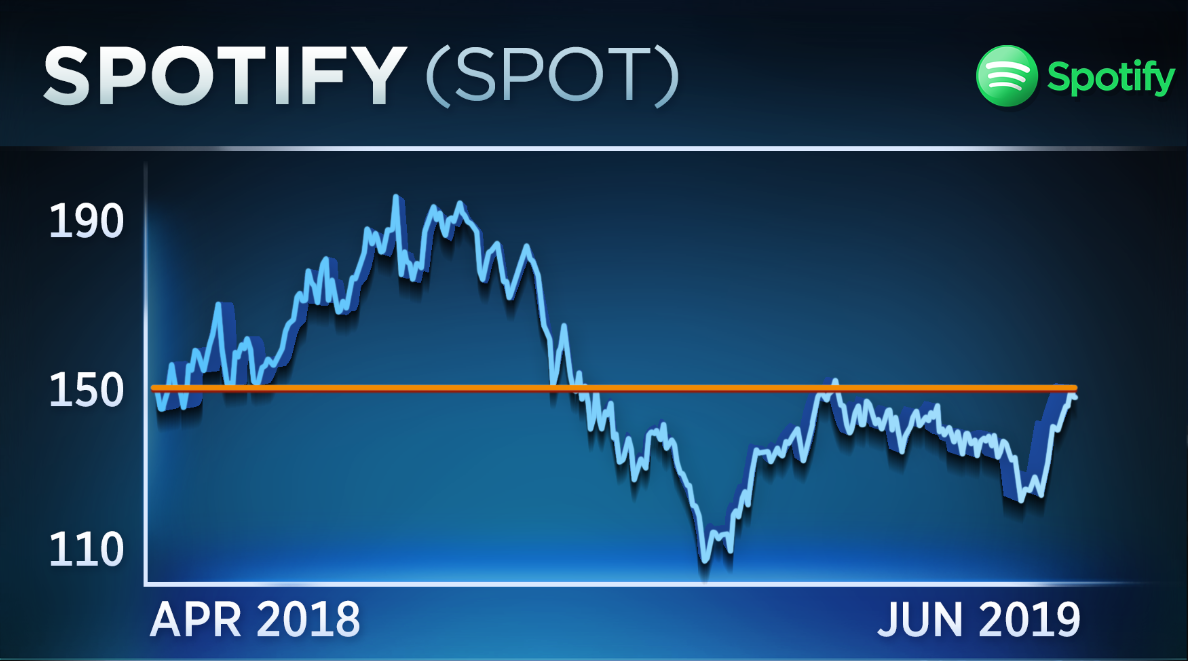

However, I uncovered a backdoor strategy at the end of March that lets investors profit from the music streaming site without owning a single share of Spotify stock. There isn't data on Spotify's revenue for 2016, but Spotify has reported negative income from 2009 to 2015. The company is still a money pit that shows no sign of profitability. While this levels the playing field for retail investors, we still advise Money Morning readers to avoid investing in Spotify stock. Investors will only be able to buy shares of Spotify on the open market. However, all of that is avoided with a direct listing.Īccording to CNBC, Spotify stock will have no predetermined price. When the public was able to buy shares of SNAP on March 2, retail investors had to pay $24 per share. It's also normally lower than what retail investors pay.įor example, well-connected investors were able to buy shares of Snap Inc. That price is only offered to hedge funds, massively wealthy investors, and large institutions. It will also allow employees to cash out their shares without underwriting fees.Īnd direct listings also have a major perk for retail investors.īefore a public offering, underwriters set an initial offering price for shares.

A direct listing will eliminate the need for a broker to underwrite the IPO, which will reduce fees. Spotify CEO Daniel Ek is planning a direct listing for Spotify stock. However, there's an interesting development with the Spotify initial public offering… What the Spotify Direct Listing Means for Retail Investors We now have confirmation the Spotify IPO is on track for either 2017 or the beginning of 2018.Īnd according to a May 12 Fortune report, the music streaming service will list shares on the New York Stock Exchange (NYSE). The Spotify IPO Will Launch on the NYSE, but There's a Better Profit Playīy JACK DELANEY, Associate Editor, Money Morning

0 kommentar(er)

0 kommentar(er)